Import and export are undoubtedly one of the most profitable platforms to perform business activities. Also, it is known to be the safest mode in terms of transactions where the money is secured by both ends, i.e., the person purchasing or importing the good as well as the one selling or exporting the goods and services to other countries.

Import-export procedure in India is easy if you follow certain criteria as it makes procedures easy and well-managed.

In this blog, we have discussed many things like what documents are needed for the import procedure in India, the procedure of import and export, documents needed for the export procedure in India, and how exactly the export and import procedure in India. The reason that prompted us to write this blog is that many people are searching for answers to questions like explaining the import and export registration procedure for India.

Starting an import and export business is not a difficult task, but it is necessary to comply with the government rules set by a particular country for a smooth flow of material and transactions.

Navigating the import-export landscape in India involves a series of well-defined steps, governed by robust regulations. Securing an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT) is a crucial initial step for both those looking to import and export goods in India. For imports, after securing a Letter of Credit, you proceed with customs clearance, where a Bill of Entry and other shipping documents are essential.

Conversely, in exports, market research in the target country sets the stage for finding potential buyers and preparing essential export documentation. With strict customs inspections and, often, varying duty fees, understanding the intricacies of import-export procedures can be crucial for smooth international trade operations in India.

There are different methods or procedures that are necessary to collect goods from a foreign market or to sell domestically manufactured products in a foreign market. Let us have a wider look at the Indian EXIM Procedures.

Import And Export Procedure in India

1. Get an Import Export Code (IEC)

The very first and the most important thing to carry out your import-export transactions is the registration of an IEC or an Import Export Code. It can be obtained from the DGFT website. The process generally takes around 15 days to obtain the IEC code.

The website also helps to understand various products or services that can be provided to different countries. It also gives information about the products restricted in a particular country. IEC is the first step of the Import-Export Procedure when a business or firm wants to register itself in the process of buying and selling goods in the international market.

2. Documents Required for an IEC Registration

Obtaining an IEC requires a PAN card, a canceled cheque, and a photograph of the person applying for the license. These are some of the basic documents which should be kept handy while applying for the registration.

Make sure the documents are complete.

3. Ensuring the Legal Compliance for Products

As mentioned above, after obtaining an IEC, a business must comply with the rule mentioned in section 11 of the Customs Act of 1962, Foreign Trade Development and Regulation Act (1992), and also it should comply with the Foreign Trade Policy. It helps in getting an insight into certain products which are allowed and which are restricted to sell or import from other countries.

4. The Harmonized System of Coding (HS Code)

Another major thing that is required is information about the HS Code or the Harmonized System of Coding when dealing with the Import-Export Procedure. The HS code helps in the identification of a product or service and plays a major role in the import-export process.

It is simply an 8-digit code. Different products or services are categorized under their own harmonized system of coding which is obtained from the Directorate General of Foreign Trade (DGFT) office.

5. Import License

For starting an import-export business, an importer must be aware of the Import License, and procuring it is important for a better understanding of their goods and services. An import license is further categorized into two types:

- A general license

- An individual license

In a general license, a person involved in the process of importing can easily import goods from any country, whereas in the individual or a specific license, the goods or services can be imported from specific countries only. These licenses are used for renewable, clearance of the imported materials.

Just like the imports, a similar process is applied for the business willing to Export. A company needs to apply for an export license from the Directorate General of Foreign Trade (or DGFT) office.

It is also needed to register the business at the ICC, known as the Indian Chamber of Commerce mentioning that the products manufactured are of Indian origin, thus allowing easy export of goods and services in the international market.

Documents for the Import-Export Procedure:

In India, there are certain criteria to perform the Export and Import Procedure in a well-managed and easier way.

Now, when a company is registered to perform import and export activities, it has to submit the documents, namely, commercial and regulatory documents.

A commercial document is one which deals with the exchange of goods and services between a buyer and a seller. According to the Foreign Trade Policy, 2015-2020, the following are the documents required under the commercial document category, these are:

- Commercial invoice cum packing bill

- Bill of lading / Airway bill

- Shipping bill or bill of exports

- Bill of entry or bill of imports

On the other side, regulatory documentation deals with the regulatory authorities. The regulatory authorities include all the licensing, customs, excise, or export promotion councils, etc.

Following are the regulatory documents required in the Import-Export Procedure for selling and purchasing of material in the international market, these are:

- GST returns, which includes both the GSTR 1 and GSTR 2

- GSTR refund form

- Bank Realization Certificate

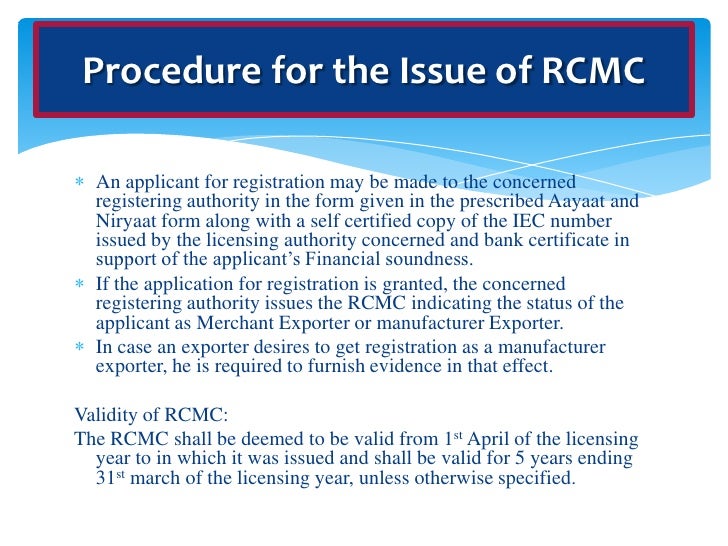

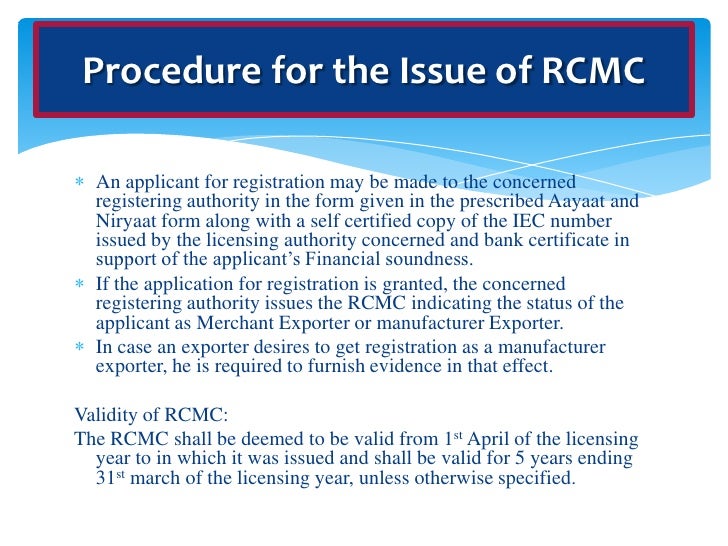

- RCMC or Registration cum Membership Certificate to avail benefits in the form of concessions

Other Import Duties:

Under the new GST laws of the Indian system, basic duty on imported items is levied as mentioned under the Customs Tariff Act, 1975, along with other duties. Also, an IGST which is an Integrated Goods and Services Tax are levied on the imported goods depending upon the classification of material under the IGST act.

So, to start with, any business owner needs to comply with the above-mentioned Import and Export Procedures in India. Apart from this, one must fully study their target market so that they should have an in-depth knowledge of the goods and services which have a demand in a particular country and vice versa. Good knowledge of the import-export market and government rules will allow any company to successfully hit the business and earn huge profits.

Where to find the best consultant to get insight knowledge of the various Import Export Procedures?

If you are looking to make your first break in the international market, then Impexperts is the right place to clear your queries and learn more about the process, documentation, and suggestions to easily handle the import-export business, while maximizing profits at the same time.

Find out more at our website and get connected with our team of experts to master your business skills.